By its very classification as a “precious metal,” silver finds itself in a small group of valuable commodities that includes gold, platinum, and palladium. This beautiful white metal has always been in demand because of its unique characteristics and relative scarcity. While demand for silver has been constant, prices can fluctuate frequently. Following are 10 factors that affect changes in the price of silver.

What Drives Silver Prices?

Understanding the pricing trends for silver requires a careful study of a number of different factors. Some of these market dynamics work against each other, making the study of silver prices more complex. For example, when the costs of production reach a certain level, any market price below those costs means less mining and supply. On the other hand, higher silver prices support more expensive mining and production, increasing supply.

We briefly summarize below the 10 price factors that serious analysts and educated investors in silver evaluate for making decisions to buy or sell silver. Of course, each of these factors generates extensive research and study, as does their interrelationships. However, an awareness of these market movers will help you understand more of why the market trends up or down.

Remember that while any one factor may gain special attention at a given time, it is important to consider all of them in context to understand both short-term price movements and long-term trends.

10 Factors that Drive Silver Prices

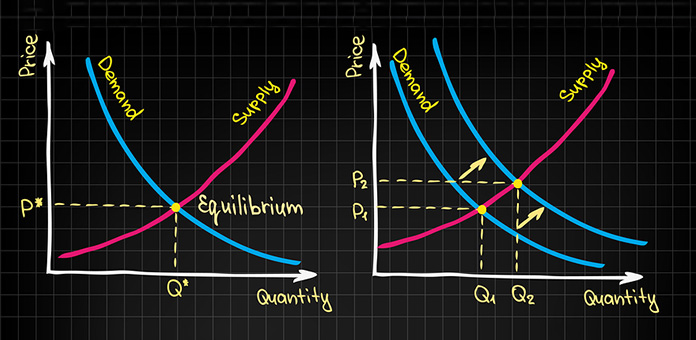

1. Supply and Demand

The supply and demand equation for silver is one reason the metal is so valuable: supply is limited but demand is constant. However, the basic economic fact of markets is that any perceived or actual increase or decrease in supply or demand will move prices, often disproportionate to the change itself. For example, if a strike interrupts mining at a major producer, silver prices may spike over the short term. Likewise, announcement of a new use of silver, such as in solar panels, will generate more buying and create upward price pressure.

2. Silver Scrap

At one point, photography consumed massive amounts of silver due to its light-sensitive characteristics. As non-silver photography has come to dominate the field, there is less demand. Likewise, there has been a very large stockpile of photographic film that has been recycled for its silver content.

Another way this factor plays out is that increasing prices will cause more existing silver jewelry, coins, and other products to be sold and melted down for addition to the market supply of silver.

It is worth noting that Silver Institute studies show much of the readily accessible stockpiles of silver and scrap have been exhausted at today’s silver prices for the commodity.

3. Technology

As noted with the change in film technology, silver prices are directly and indirectly moved by existing and new technologies. Many of these new uses for silver take advantage of physical characteristics found only in this metal, making it virtually irreplaceable.

Contradicting that is the fact that new technology is, in fact, helping to replace silver in more mundane applications. For example, new types of aluminum alloys are acceptable replacements for some cheap mirrors. The same goes for the common use of stainless steel flatware in many households rather than the traditional silver items.

Nonetheless, it is new demands from solar photovoltaic systems and many green applications that generally make technology a net bullish factor for silver demand and prices.

4. Economic Trends (Micro)

In good economic times, people spend a great deal of money on jewelry and items that contain precious metals, such as silver. Likewise, if incomes stagnate or drop, such purchases are often the first to be deferred. The level of growth and economic health in emerging markets is watched as a major indicator of this segment of demand.

However, even in rough economic times there is often demand for luxury products, including watches and fine jewelry. Reports on the trends in this area of high-end demand often serve as an indication of overall economic trends, which influences silver prices.

Unlock Silver Investor Trade Secrets in our Investor Report.

Get Your Free Report5. National and Global Economic Trends (Macro)

Silver, along with gold, is considered to be a safe haven investment. This means that silver is seen as retaining its value and purchasing power better than paper currency and certain other assets when there is economic uncertainty. When and if those economic concerns turn into full crises, there is generally significant upward pressure in prices for silver and other precious metals.

The other side of this issue is that a strong, vibrant economy may decrease demand for silver from investors and other buyers. While that active economy will generate greater demand for silver in industrial and jewelry applications, it does not pay a dividend or generate interest income.

6. Inflation

Most analysts, economists, and investors understand the insidious nature of inflation on portfolio value. This includes even nominal inflation compounded over long periods of time. Silver, on the other hand, is seen historically as a great hedge against that inflation. Inflation will erode the value of paper currency, and silver can provide protection against such losses in purchasing power.

7. Strength of the Dollar

As the leading global currency, the U.S. dollar generally has an inverse relationship with the price of silver. Silver market participants have seen a history of a strong dollar creating pressure on the price of silver. At the same time, many savvy investors watch for times when the dollar is strong to average down their holdings by finding bargain prices for their purchases.

8. Gold Prices

While the real significance of the gold silver ratio is the subject of intense debate, there is a historic relationship between the price of gold and that of silver. In general terms, as the price of gold moves up or down, silver prices will follow. Some specialists trade based on the GSR, buying or selling as silver is expensive or cheap relative to the current price of gold.

9. Interest Rates

Mentioned briefly above, the level of interest rates is an indication of overall market conditions. Since investments in silver are not made to get a current return, some investors will opt for interest payments in the place of long-term appreciation of silver holdings. Therefore, silver’s market prices generally have an inverse relationship with the level of interest rates, similar to the strength of the dollar.

10. Government Policies

Due to its long history of use as a medium of exchange, silver markets continue to be influenced by government actions and policies. For example, while gold gets most of the attention as a reserve, central banks around the globe buy and sell silver bullion. National mints, such as the U.S. Mint, consume a great deal of the world’s supply of silver by producing both bullion and numismatic-quality coinage.

Investing in Silver

Along with these factors, it is important for you to understand the difference between speculation and investment, as well as short-term and long-term investing. The very nature of markets is that they react rapidly to short-term factors like those cited above. Speculators and end users, such as jewelry manufacturers, find it important to watch these rapid changes.

However, most long-term investors are more interested in evaluating the trends that these factors indicate. The key to that long view of investing in silver is to enjoy the protection it offers, pick up bargains when possible, and rest assured that the value of silver holdings will increase substantially in the years to come.